What to Do if Your Windshield Cracks – Will Insurance Cover it?

Let’s say that you’re driving down the road on your way to the market, and you get stuck behind a large work truck. There’s no other lane to go into and it starts to rain. This can make you easily frustrated as you can’t see a thing and then all of a sudden, smack, that truck’s tire picks up a rock and throws it directly at your windshield.

Let’s just say that many people understand what you’re going through. That rock left some damage to your windshield, and you really are afraid to turn it in due to the high cost of the deductible you took out just to save a few dollars per month on your premium.

- Cracks – Believe it or not, there are several types of cracks that a windshield can suffer. The first and most common type is the chip. The chip is a small piece of windshield that is taken out due to an object being propelled towards it. The second type and most dreaded is the spider. As the name states, the crack resembles that of a spider’s web.

- Weather – If and when you experience a chip or spider crack, you will need to call your insurance company immediately or else the feared expansion will happen to your windshield. An expansion is when the owner does not take care of the crack and harsh weather makes the crack expand. It doesn’t matter if you live in Florida or Antarctica, extreme cold and hot weather is going to affect the windshield.

What to Do

You don’t need to panic when a stone or other object strikes your windshield. That is what comprehensive insurance is for. It takes care of you and your vehicle when the inevitable happens. Once you get home, all you need to do is call your insurance carrier and ask them to give you a rate on how much it will cost to cover the damage.

Sometimes an insurance carrier will deem the accident an “act of Mother Nature” and cover the crack under another type of policy other than your main policy. Most people are relieved to find out that they don’t have to pay that much out of pocket.

Not Covered

If you do not feel like going through your insurance provider to take care of the crack, you can always go straight to the dealership to see what it costs to replace your windshield. It’s a good idea to go straight to where you purchased your car. They will automatically know how to get another one and how much it will cost.

There are currently so many windshield repair companies that are able to assist you when needed. They don’t replace the entire windshield, but come out to wherever you are with a suction type device. They put the device directly on the crack and it seals it up. This may cost a little bit more than replacing your windshield, but at least you can have the job done in a few minutes as opposed to a few days.

Prolonged Crack

If a crack does not go below the rearview mirror, then most people do not bother replacing it. They don’t mind it because they no longer have to worry about the crack’s effect on getting your car inspected. This only applies in states that have inspections.

If you let the crack go on for too long, it may not be covered by your insurance provider. Insurance companies like to take care of accidents and other roadside mishaps as they occur, not months later. The longer you put off replacing it, the quicker your insurance company is going to deny you the right to get it fixed.

Comprehensive insurance providers have a standard in which they can pay for the vehicle to get repaired. An adjuster will come out to wherever you live and put a piece of paper on the crack. If the crack goes longer than the paper, they will not cover it. The opposite occurs when the crack meets the perimeters of the paper.

Insurance

When shopping for comprehensive insurance, make sure that you find a policy that fits all of your needs. That is not only reserved for accidents and medical coverage, but other things such as windshield cracks because they occur more so than vehicle accidents. They will also end up costing you more money if you haven’t gotten the right policy coverage, so do your research first.

What to Do If You Have Hail Damage

Out of nowhere a storm can suddenly erupt, making you wish you had remembered to roll up the car windows. Even worse, this storm could produce hail the size of golf balls. Now you wish you had also bothered to pull the car into the garage.

When the storm finally ends and the sun begins to peak back through the clouds, you decide to survey the damage. The prognosis – not good. Hail can leave a few minor pock marks, but it can also cause enough cosmetic damage to render the car a “write off.” That means it would cost more to fix the car than to replace it. That’s without even taking into account how badly your windshield or windows could be damaged or even destroyed from hail being pelted at them.

Either way, you are probably looking at some expensive repair or replacement costs. Of course right about now as you begin to file a claim with your auto insurance provider, you are going to be hoping that hail damage is even covered by your car insurance.

Hail & Auto Coverage

It is important to file a claim because you are probably not going to want to pay for the repairs out of your own pocket. This can be an extremely costly problem to fix. Not only that, but if it goes unreported and you have to file a claim for something else down the road, your insurance could deny the claim because of the unreported and unexplained damage.

Of course the most important thing is making sure that your auto insurance even covers hail or storm damage. The scary thing is that too many drivers make the assumption that they will be covered by their policy provider for this type of damage. When it’s time to cover the repair bill they find out their insurance isn’t picking up the tab.

Making Sense of It All

- So how do you know if you are covered? The best thing to do is contact your policy provider to make sure. Most of the time, your hail damage would be covered if you have comprehensive car insurance.

- What is comprehensive insurance? Comprehensive is best known for being that part of auto insurance policy coverage that protects you where other types leave off. Things such as fire, storm damage, theft, and even vandalism are usually only covered by comprehensive insurance.

- Doesn’t comprehensive insurance come with any policy? No! In fact too many drivers who get more than just liability think they are automatically covered for the problems that comprehensive takes care of. There’s lot more to getting your car and yourself as a driver covered than just meeting the state minimum requirements. It’s time for you to get proactive and find out how to get the fullest coverage you need to prevent paying out of pocket for damages.

Don’t take a gamble any longer with your auto insurance coverage. Using just your zip code you can get free quotes to find out what it would cost for comprehensive coverage.

What to Do If You Hit a Deer? Will Insurance Cover It?

Hitting a deer can be a scary experience. Unfortunately it can also be an experience that causes bodily injury and damage to your car. Every year as many as 200 people are killed in deer related car accidents, not to mention how many deer are injured and left to die after being struck by a vehicle.

The best advice to follow is to do your best to try to avoid coming in contact with a deer while driving. You can help make this happen by making it a point to slow down when you see a deer. They can be unpredictable, so even if it has already crossed the road, it could suddenly dart out again.

Also, when you see one it usually means there are others close by. Be ready to drive defensively and to react to avoid an accident. Because deer are nocturnal and tend to begin grazing at dusk, make sure you are paying closer attention during this time of your drive. Here’s another great guide telling you what you should do if you hit a deer with your car and what happens afterwards.

After the Crash

If you are about to hit a deer, it is not a good idea to try to swerve off the road or into oncoming traffic to try to avoid it. Hitting another car or a tree head on could cause even more severe damage. If you hit a deer, you should then pull over to the

side of the road, if possible. Here are some other things to do:

- First of all, stay calm.

- Avoid contact with the deer, its hooves or antlers.

- Call 911 or ask another driver to do so.

- Set up road flares if you have any in your emergency kit.

- Contact your insurance policy provider.

Once the dust settles, hopefully both you and the deer can survive the crash with little to no injury.

Understanding Your Insurance

One thing most drivers want to know once the crash is over is who is going to take care of the expenses involved. Unfortunately too many drivers find out after hitting a deer that their policy doesn’t cover that. If you are assuming your car insurance covers hitting a deer or any stationary or mobile object, you had better double check.

Most of the time, the only policies that cover hitting a deer include comprehensive coverage. Although collision sounds like it should cover a collision with a deer or other animals, most of the time it doesn’t. Collision is usually meant to cover only an accident involving another vehicle.

Comprehensive insurance is what covers those problems collision doesn’t, such as:

- Hitting a deer

- Storm damage

- Fire

- Theft or vandalism

Either way it may be time for you to do a little research to find out what your current policy covers. Better yet, why not get quotes for to find out what you could be paying to get comprehensive coverage as part of your policy. Even if you already have coverage, you owe it to yourself to get a free look at how much you could be saving on your car insurance.

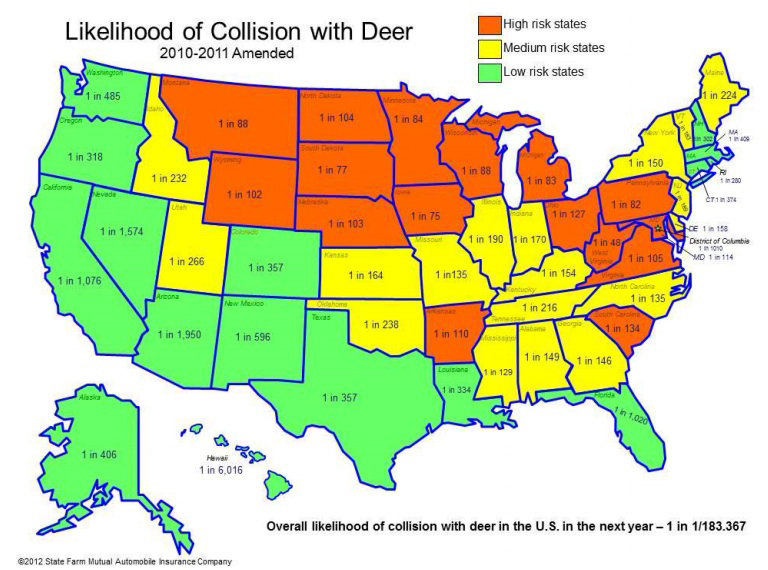

State Farm recently came out with a study that shows the odds of hitting a deer by each state:

Things to Keep in Mind When Doing a Comprehensive Car Insurance Comparison

You’ve decided you need to beef up your car policy coverage and include comprehensive car insurance, the thing is you aren’t sure you really know all you need to know about rates and coverage for this. You may even already have a policy that includes comprehensive but aren’t sure if the rates you are paying are fair. Whatever the reason, there are some important things to keep in mind when it comes to your car insurance policy and coverage.

Point #1 – What is comprehensive car insurance?

Comprehensive auto policy coverage is a type of coverage you may need if you have a financed car or if you simply want the ultimate auto insurance protection when you are on the road. What is surprising about comprehensive coverage is that most people get this and collision confused. Other drivers tend to think of comprehensive car insurance as the insurance that picks up where standard collision leaves off.

Point #2 – What is the difference between collision and comprehensive car insurance?

It should be simple, really. Collision insurance covers you if you are the at fault driver in a collision, right? The problem is most collision policies only cover an accident involving another vehicle. While this is certainly the most common type of collision there are plenty of collisions that happen every day involving an animal or a structure such as a home. For these types of collisions, comprehensive usually takes over.

Point #3 – What else does comprehensive auto insurance include?

Aside from the collision that collision car insurance does not cover, comprehensive auto coverage usually also covers things such as damage from fire, floods or other natural disasters. Need protection from what insurance companies refer to as an act of God? More than likely your comprehensive policy will cover you for this. Also if you should suffer damage from vandalism or if your car is outright stolen, this is the kind of coverage you want protecting you.

Point #4 – Comprehensive isn’t without its own gaps.

If you have a financed car, you may be surprised by how many types of coverage you must have to protect yourself and your car. While comprehensive is basically the best, especially when paired with collision, for your financed car you may still need gap insurance coverage. Gap does fill in the last remaining gaps, sure. This is not however the reason why it is called gap insurance. This stands for Guaranteed Auto Protection and is what helps you make sure your asset is covered. When you leave the lot with your brand new car, the amount you owe on the loan is greater than the value of the car. The value of the car is what insurance companies cover if the car is totaled out or stolen. If this should happen, there would be a balance due remaining based on the difference, which you would have to pay for out of your own pocket. Gap insurance helps protect you from having to pay thousands of dollars out of your own pocket for this kind of issue.

Point #5 – It is important to know if you need comprehensive or would be just fine with liability.

Keep in mind there is a fairly wide gap between liability and comprehensive car insurance. If you outright own your car, you may not need something as extensive as comprehensive car insurance. However settling for just liability could leave you with too much financial responsibility should something happen to your car. This is especially true if you do not have health insurance because you may be left with serious medical bills in the event of an accident. When you compare comprehensive car insurance rates, you can be assured that you will have almost all the coverage you need at the best rates available.

So now you should have an idea of some of the factors that go into comprehensive insurance and the rates. Keep in mind there are still many factors that can affect the rates including the type of car you buy, your driving record and even the state you live in. In fact, your very own zip code can play a major role in the rates you pay.

Ready to find out what these rates could be?

Find out just how affordable auto insurance coverage may be for you by using nothing more than your zip code to get started. From there you will see the difference in comprehensive car insurance rates and how to make the best choice for your policy needs.

Saving Money on Comprehensive Car Insurance

If you own a car, you are required by law to carry a certain amount of liability insurance, or in some states you can waive the insurance if you can prove financial responsibility. While this coverage will pay for damages that you cause to others, including vehicle repairs and medical costs, it is not going to take care of any of your own expenses. For instance, if you want to be sure that you are going to be covered no matter what happens to your vehicle, you should have comprehensive car insurance.

What is Comprehensive Car Insurance?

Many things can happen to our vehicles, and we don’t have to be in actual accidents for things to happen. This is why it is wise to have comprehensive car insurance. This type of coverage will pay for damages that are caused by acts of God, such as earthquakes, hail or other severe weather. If your vehicle is stolen, your comprehensive car insurance will pay to replace it. If your vehicle is vandalized, this coverage will pay for repairs.

Full Coverage Insurance Policies

Most of the time people include comprehensive car insurance in a full coverage policy. In addition to comprehensive insurance, these policies also offer the liability coverage that you are required by law to have, as well as collision coverage so if you are at fault in an accident you will have a means of paying for your own damages. Without this type of coverage you may or may not be able to afford to pay for your own expenses, which could include extensive medical bills.

Discounts You May Qualify For

When you are shopping around for comprehensive car insurance, you need to be aware of the many discounts that are offered by insurance companies. Not all insurers will offer the same discounts, which is why you need to get quotes from many different insurance companies to compare products and rates. Some of the discounts you should inquire about include:

- Multi-Vehicle Discounts – If you have two or more vehicles, you will save money on your comprehensive car insurance by having them all insured under one policy. Some exceptions to this include motorcycles and RV’s, which must have separate coverage.

- Multi-Policy Discounts – If you are carrying more than one type of coverage, you can combine it with your car insurance. Many insurers will offer discounts to customers who buy their home, life and auto insurance from them. It not only saves you money, it also saves a lot of hassles because you are only dealing with one insurer.

- New Vehicle Discounts – If you are planning on purchasing a vehicle, take note of the fact that buying a newer model vehicle will help you to save money on your comprehensive car insurance. New vehicles usually come equipped with the newest safety features. These features are what insurers want to see, and they will help you get discounts.

- Customer Loyalty Discounts – If you have been dealing with the same insurance company for many years you should ask if you can get a discount for your loyalty. Many insurance companies offer these discounts. The more discounts you qualify for, the better your insurance rates are going to be.

Maintain a Good Credit Rating

Your credit record is going to help decide what your insurance rates will be. While this may sound kind of dumb, it does make sense when you look at it from the point of view of insurance companies. If you don’t have good credit, it means that you have a history of having late or delinquent payments to creditors. Insurance companies will charge you higher rates because of this, at least until you have a history of paying your premiums on time every single month.

It’s Time to Do Some Comparison Shopping

When you are trying to get the best deals on comprehensive car insurance you need to do a bit of comparison shopping. Just like with any big-ticket purchase, insurance is not something that should be taken lightly. You need to check out what the different insurance companies have to offer. As noted earlier, not all insurers offer the same discounts, and they all offer varying products at different rates. You can do your comparison shopping online, which is going to save you a lot of time, and in the long run, money. Give us your zip code and we will search through our data bases to get you free quotes from local and national insurers. Then you can do your comparison shopping and decide which insurer has the best deal on the coverage you need, including comprehensive car insurance.

Top 5 Things to Know When Getting Comprehensive Car Insurance Quotes

There is so much information out there when it comes to auto insurance it can be hard to make sense of it all. The problem is this can be very important and useful information for you when it comes to getting your comprehensive car insurance quotes or new policy. Although this list does not cover every single thing you need in order to be protected with comprehensive auto insurance, it can be a great place to start.

#1: Find Out If You Need Comprehensive Car Insurance

For many drivers on the road these days, the state minimum required insurance may be enough. In some states this is simply liability insurance coverage. In other states, it is no fault or PIP (Personal Injury Protection) coverage. For other drivers, there may be a need for more coverage.

In most cases if you are financing a car, you will need comprehensive auto coverage, as well as some other types of coverage. The important part is to make sure you have it if it is required by your financial lender for your auto loan. If not, the lender will tack on their own pricy policy, which you will end up paying for at the end of the life of the loan.

#2: Know About Your Driving And Insurance Past And Present

You should find out if the policy you currently have includes comprehensive car insurance coverage or not. You should also learn about what your driving record actually is and how much it impacts your current rates. This is especially important if you have had any previous tickets or accidents on your record.

Previous infractions come off after three years, so make sure your rates are not currently being affected by old news. If you have the same policy you have had for a few years, more than likely your old infractions are still causing your rates to be higher than they should. That is another reason shopping for a new policy could help you get a fresh start with lower rates.

#3: Be Aware Of the Many Ways You Could Be Eligible For Discounts

When getting your comprehensive car insurance quotes there are many things that could help you get an even better deal. For example, if you are a younger driver, you could qualify for a good student discount. If you are in the military active duty or a retired vet, you should be taking advantage of the discounted rates available to you.

Not only that, but there are other ways to get better rates and great savings. For example if you can bundle up your policies you could see huge savings. Say you have life insurance with one company, renter’s insurance with yet another and your spouse has his or her own car insurance with yet another policy provider. Bring all of these together and what does that spell? Savings. Bundle policies for easier and cheaper payments.

#4: Evaluate Your Own Policy

The current comprehensive car insurance policy you have may have been the best deal around when you signed up for it. Of course, like most drivers, you probably got your basic coverage in place from the first offer that came along and have put it out of your mind since then. Who wants to think about a task you already have completed, right?

The problem is your policy rates may be as outdated as your driver’s license photo. It is always a good idea to get a rate “health check up” at least annually or whenever the policy is up for renewal; whichever comes more frequently. It has never been easier to get FREE comprehensive auto insurance quotes, so why not take advantage of the service so you can take advantage of the super savings on your policy premiums.

#5: Shop Wisely for Your Car

The flashy red convertible sports car may look cool, but you are going to probably need a second or third job to pay for it as well as the auto insurance rates that come with it. As dull as it may sound, you should try trading flashy whistles and bells for safety features when it comes to your next new car purchase. Add on an anti-theft device and you will see an even more severe drop in your rates.

This can also apply to the car you currently have. If you can add on safety features such as air bags and anti lock brakes, your insurance should reflect this. Not only are you ensuring your own safety, you are insuring your automobile for a great deal less.

The Bottom Line

Aside from what you must have based on your lender’s guidelines, the rest is up to you. If you do not have a financed car, you may opt to not carry comprehensive but this could be a mistake if your car is of any value. When you get competitive quotes from auto insurance policy providers you may find you can even get better coverage than you currently have to lower premiums than you currently pay. When it comes to auto insurance, it is better to have too much than not enough coverage.

Auto insurance premiums can still be expensive, true, but by shopping around you may be shocked at how low they can be as well. Ask about other possible discounts for things such as multiple cars or if you go paperless with your billing. Of course the important thing is to always make sure you have some type of auto insurance coverage.

Even if you are just driving a friend’s car for a few months while you save up to buy your dream car, make sure you only get behind the wheel if you have your non owner’s insurance policy in place. If you think you may need it though, getting comprehensive car insurance coverage is one of the best ways to protect yourself as a driver on the open road. Using just your zip code, you can get started getting your cheap quotes for this right away.

Finding the Cheapest Comprehensive Insurance Quotes

Comprehensive insurance quotes are a great way to find out how much your policy premiums may cost you. This was at one time a difficult task to manage. To get different quotes, you needed to contact each individual insurance policy provider and give them all of your personal information. Following that, you would have to wait for each one to call you back a few days later. Each car insurance company that didn’t call you back you would then have to call up to try to track the quote down.

The worst part? Most companies didn’t worry about competing for your business so each one had very high premium rates instead of cheap and competitive ones. It is no wonder drivers ended up settling for the first rate they got instead of trying to wait for the lowest rate. In most cases, the lowest rate wasn’t going to be that much better anyway. Time have certainly changed and now getting comprehensive insurance quotes is as easy as supplying your zip code.

Why Get Comprehensive Insurance Quotes?

You may need comprehensive car insurance if:

- You have a financed car and the lender requires you to have it.

- You have a car that is still of great value and you want it fully covered.

- You are concerned that your valuable car may need coverage in addition to just collision insurance.

- You want to be sure your car will have coverage for all of those things not related to a collision with another vehicle, such as hitting a large animal or fire damage. Even protecting yourself from vandalism and theft can only be done through comprehensive car insurance policy protection.

The problem is most drivers don’t even realize what comprehensive and collision actually cover, which makes it difficult to be sure you have what you need in place. The trick is not to wait until you need to file a claim to find out you should have had comprehensive coverage.

Do You Need Comprehensive?

If you are considering getting comprehensive insurance quotes then you probably want to find out if this is even the right kind of insurance for you. If your car is financed more than likely you should have this type of auto coverage. There are no states that require comprehensive auto coverage to drive legally. However to protect your financed vehicle you may want and need this. Or if you have a vehicle that is still of great value, comprehensive auto coverage may also be of great value to you.

There are a few things to think about when it comes to comprehensive coverage. For instance:

- The condition and value of the car – Even if you love your car, if the value is not that great you may not need this kind of coverage. Check to find out your car’s true value for its current condition to find out if you need more than liability on it.

- The use and amount of use for the car – Even if your car should have great value but you put a great deal of miles on it, the value will depreciate rather quickly. So, even if you buy a new car and pay cash for it instead of finance it, be realistic about if you are going to beat it up as a work vehicle or add too many miles on to it to prevent the vehicle from retaining a high value.

- Your own finances – You may be considering skipping comprehensive coverage because you would rather save a few dollars per month on the premium payments. However, should your car sustain damage from fire, flooding, storms, an Act of God, theft or even vandalism are you prepared to pay these damages from your own pocket? It is important to weigh the pros and cons of having comprehensive auto insurance to help make your decision. It is also important to realize a few extra dollars a month could prevent you from having to pay a high amount from your own pocket in the event of an accident.

Watch for things instead that could possibly help lower your rates like student discounts or military car insurance rates. Keep your driving record clean and make sure you do not let your auto coverage lapse for more than 30 days.

If you are ready for your quotes all you need to do is supply your zip code. From there you will get the cheap comprehensive insurance quotes that will help you start saving money.

The Driver’s Guide to Comprehensive Insurance

Comprehensive insurance is actually a type of coverage most drivers may think they have with standard car insurance coverage but are probably wrong. If you are the type of driver who only wants or needs liability insurance, then comprehensive insurance may not be what you need. Or if you live in a state that requires PIP or Personal Injury Protection then you may not need comprehensive. However, if you want total protection or have a financed car, more than likely you will not only want comprehensive car insurance you will be required to carry it.

The first thing you should know is what exactly comprehensive auto insurance is. Understanding what comprehensive car insurance coverage is, will help you be certain you have total coverage when it comes to protecting your car and yourself as a driver. There is some confusion generally about comprehensive versus collision insurance coverage, but once you comprehend comprehensive it should all make sense.

The Basics of Comprehensive

When it comes down to understanding your own car insurance coverage or options, one thing that can get confusing is what exactly comprehensive car insurance is and how it covers drivers. Here are some things to know about comprehensive auto insurance to help you gain a better understanding:

- Generally, comprehensive insurance is the coverage that covers issues other than collisions with other cars. The problem is many drivers assume their collision coverage takes care of any problems that may arise, including all collisions.

- While some collision policies do cover all types of accidents, many do not. For example, if you have an accident with another vehicle then you should be covered. However if you have a collision with a deer or even a structure such as a house, your collision policy probably will not cover it.

- Comprehensive takes over where collision does not, in most cases. Aside from collisions with animals or inanimate objects your comprehensive usually also protects against fire, theft, vandalism, floods, natural disasters, Acts of God or other types of damages that are not covered under other auto insurance policies.

- The driver would still be responsible for the deductible as is standard with all insurance policies. Also, you will probably still want collision insurance and may be required to have it. In fact you may even need gap insurance coverage on top of your comprehensive coverage.

- Where comprehensive and collision leave off, gap auto insurance picks up. For financed cars you often need all three of these. While the first two cover your damages often, gap helps if the car should be completely damaged and totaled out or is stolen and unrecoverable. The amount you owe for your car loan is usually much greater than the value of the car. If the car should be totaled out your standard insurance would only pay what the value of the car is, leaving you responsible to pay the rest out of your own pocket. To insure this difference, you will also need GAP insurance.

Do You Need it?

If you have a financed car, more than likely you need comprehensive auto insurance. Or if you have a car of great value that you want more than liability auto insurance on, you may also want collision and comprehensive. Although it is not required by any state it is more than likely mandatory by the guidelines of your car loan lending company. The problem is if you do not have all of the coverage in place that you need your finance company may do this for you.

The insurance coverage a lending company tacks on to a financed vehicle is never cheap. Often times you may not even know the lender has added comprehensive insurance or other types of car insurance you are lacking until the end of the loan. Or until what you thought was the end of the loan. When you go to make your final payment you are likely to find you still have a large balance due. This balance will be the insurance coverage the lender put in place for your financed car.

Other Things to Ponder

If your car is of any value you will probably want to have comprehensive car insurance as well as collision. There are too many things that can happen to your vehicle and things you cannot plan for. Of course, there are also a lot of factors that go into determining what your policy premiums may be. For instance:

- Where you live – Your state right down to your zip code will have a lot to do with your premium costs. Take for instance states with a higher likelihood of tornadoes. Then factor in what your rates could be if your zip code falls into an area that doesn’t have as high a chance of getting hit with a tornado. Right away, this helps lower the likelihood of you having higher rates for this part of the state.

- Where you park at night – Aside from your zip code even where you park at night has a lot to do with the premiums. If your vehicle is kept safe from theft, vandalism or even storm damage inside a garage you will probably have lower rates. However, if you park on the street in an area known for higher crime or statistically more chance of storm damage, you may have higher rates.

- Your deductible and method of payment – The higher the deductible the lower the premiums. Of course, be careful because a high deductible like $1,000 may make it difficult for you to come up with at the time of a claim. Just avoid having too small a deductible because your rates will be higher. Also, when making your payments try to set this up for auto pay. Skipping having the bill sent out will help cut down on your monthly payment amounts.

If you are ready to find out how low your insurance rates could be all you need is your zip code to get started. By doing this you will get the comprehensive insurance you need to be protected.

How to Get Cheap Comprehensive Car Insurance

If you are trying to find ways to get cheap comprehensive car insurance, you are in luck. Insurance can be expensive, but when you know about the different ways to save money you can get much better deals than the next person who is not aware that they could be paying less. Cheap comprehensive car insurance is actually pretty easy to get. All you have to do is get quotes from various insurers, find out what discounts you are eligible for, and see who is offering the best rates on the coverage you need.

Getting Discounts on Your Comprehensive Car Insurance

While it is often much more expensive to have full coverage, you can get cheap comprehensive car insurance which is much better than just the minimum liability insurance that is required by the state you live in. You can find many ways to save money on your insurance. This way, you will know that you can afford to have the coverage you really need. After all, liability coverage is fine and dandy, but it isn’t going to help pay for any of your own damages if you are at fault in a car accident. You may be eligible for a number of discounts that are offered by a lot of insurance companies. Some of these discounts include:

- Safe Driver Discounts – Your driver’s abstract will show insurers whether or not you are a high risk or a safe driver. If you have a clean driver’s abstract for a certain amount of time, usually three or more years, you may qualify for a safe driver discount.

- Multi-Vehicle Discounts – Owning more than one vehicle help you get cheap comprehensive car insurance if you combine them all on one policy. There are some exceptions to this, such as motorcycles and recreational vehicles, which require separate coverage.

- Multi-Policy Discounts – Many insurance companies will offer discounts to customers who choose to let them handle all of their insurance needs. Combining auto, life and home insurance is a great way to save money, and make it much easier to get cheap comprehensive car insurance.

- Military Discounts – If you are a current or retired member of any branch of the US military you may be eligible for a discount of up to 15% on your comprehensive car insurance. You can even find some insurance companies that specialize in insurance for military members and veterans.

Quotes: Another Great Way to Get Good Insurance Rates

When you are trying to get cheap comprehensive car insurance, you need to shop around to make sure that you are not going to be paying too much. Even if you are already insured, it never hurts to find out if you could be dealing with an insurance company that will charge you less for the same type of coverage.

Quotes are free, and you are never under any obligation to purchase anything. Go online today, give us your zip code, and you will have all the quotes you need in a few minutes. Then you will be able to get the cheap comprehensive car insurance you want.

Keeping Your Costs to a Minimum with Georgia Comprehensive Auto Insurance

While Georgia residents enjoy a yearly insurance cost that is below the national average, there are always ways to reduce the cost you have to pay. Insurance costs for the state are at number 22 in the nation. Nationwide, the yearly cost of insurance is around $1,800, while in Georgia, the average rate is $1,700. In addition, other insurance related expenses for Georgia and the national average compare this way:

- Accident rates in the state are below the national average.

- Vehicle repair costs are also below the national average.

- Vehicle theft rates are below the national average.

One dark spot should be noted, however: the rate of auto insurance fraud in Georgia is higher than the national average.

Vehicle Theft and Comprehensive Auto Insurance in Georgia

Getting your car stolen is never good, but not having the right car insurance can make it even worse. Only comprehensive auto insurance will cover the cost of your vehicle if it is stolen as well as damages incurred by the person who stole the car in the first place. More vehicle theft information for Georgia:

- In 2009, there were just over 33,000 vehicle thefts in the state, which equals 337.2 per 100,000.

- On a list of the top 20 worst cities in the US for auto theft, only one Georgia city is listed. That city is Macon at number 14.

In every state, there are certain types of cars and trucks that are stolen more than others. In the state of Georgia, the top ten of those vehicles are:

- Honda Accord (1994)

- Chevrolet 1500 Pickup Truck (1994)

- Chevrolet Caprice (1987)

- Oldsmobile Cutlass (1986)

- Ford 150 (1997)

- Honda Civic (1993)

- Ford Explorer (1996)

- Jeep Cherokee (1994)

- Toyota Camry (1994)

- Ford Taurus (1996)

Before You Decide if You Need Comprehensive Auto Insurance in Georgia

There are some situations where you might not need comprehensive insurance. In Georgia, there is mandatory insurance which provides a minimum required coverage amount. Those minimums are:

- $25,000 for each person/bodily injury

- $50,000 for two or more people/injury each accident

- $25,000 for each accident for property damage

Keep in mind that these minimums do not cover your own costs for damages to your vehicle or property or your injuries. In addition, this coverage does not cover certain types of events, including hitting an animal or weather related damages. Comprehensive insurance can cover those expenses for your own and other people’s vehicle and property.

Do You Always Need Insurance?

While Georgia does require minimal insurance, it does provide for some exemptions. Those include:

- When the owner moves from the state

- When the vehicle’s lease term has expired

- When the car has been repossessed, has been stolen or has been declared inoperable

- If the car has been sold or the ownership has somehow been transferred

- When the car is being stored or is only being used seasonally (for agriculture purposes)

- When the car has been wrecked, junked or salvaged

If you rent a car in Georgia, your rental car must have at least the legally required insurance. Do not rely on your credit card- that protection for your car does not exist and can leave you at fault for damages to the car and any other property in an accident.

Comprehensive Auto Insurance in Georgia: What Happens if Coverage Lapses?

A lapse occurs when your insurance coverage has expired for more than ten days in a row. If you know that you cannot pay the premium, immediately contact the agency that you are dealing with to ask for advice instead of just allowing it to go to lapse status. In Georgia, if your insurance coverage has lapsed:

- Your vehicle registration could be suspended.

- If that happens you will pay a $25 lapse fee followed by a $60 reinstatement fee.

- Fees increase for second and third offenses.

- By the time you reach a third offense, the reinstatement fee is $160.